The financial services industry operates and manages vast amounts of confidential client and customer data for daily business transactions. Due to the high value of this information, it has become one of the prime targets for cyber threats and data breaches. The ability to safeguard personal data without compromising accessibility and usability is now a strategic differentiator.

Our client, a renowned wealth management institution, needed an automated redaction and anonymization solution that balanced AI for data security with operational flexibility. They sought a PII protection AI use case that could handle sensitive client information accurately and efficiently while reinforcing a culture of privacy-preserving machine learning across their organization.

After a detailed assessment of the client’s ecosystem, we engineered a data anonymization AI solution for automated redaction — leveraging AI and ML to detect, extract, and redact personal identifiers from multiple data sources with unmatched precision.

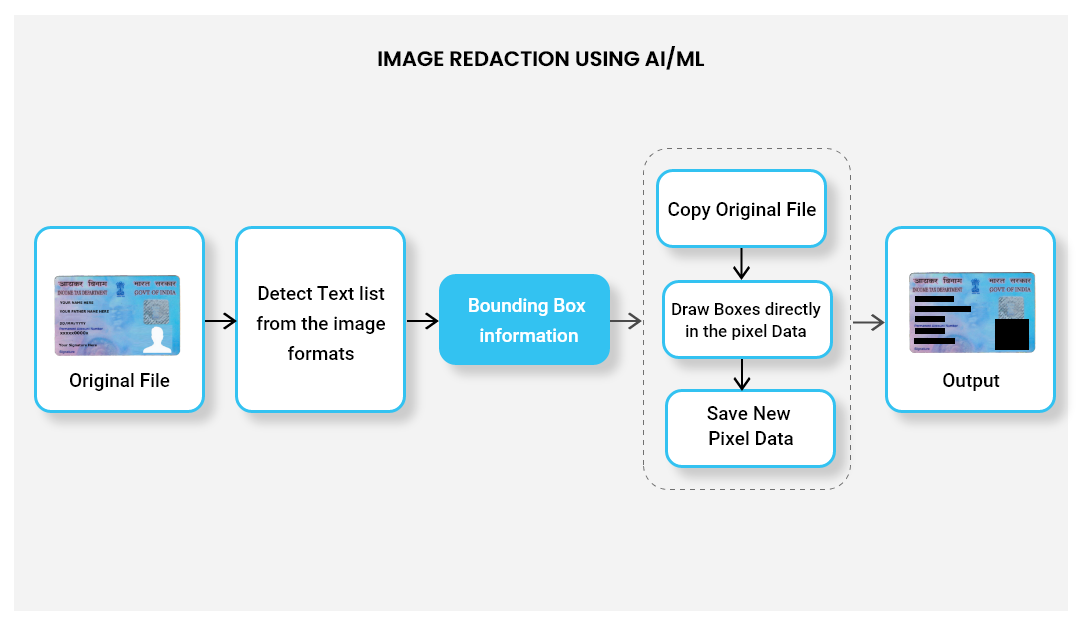

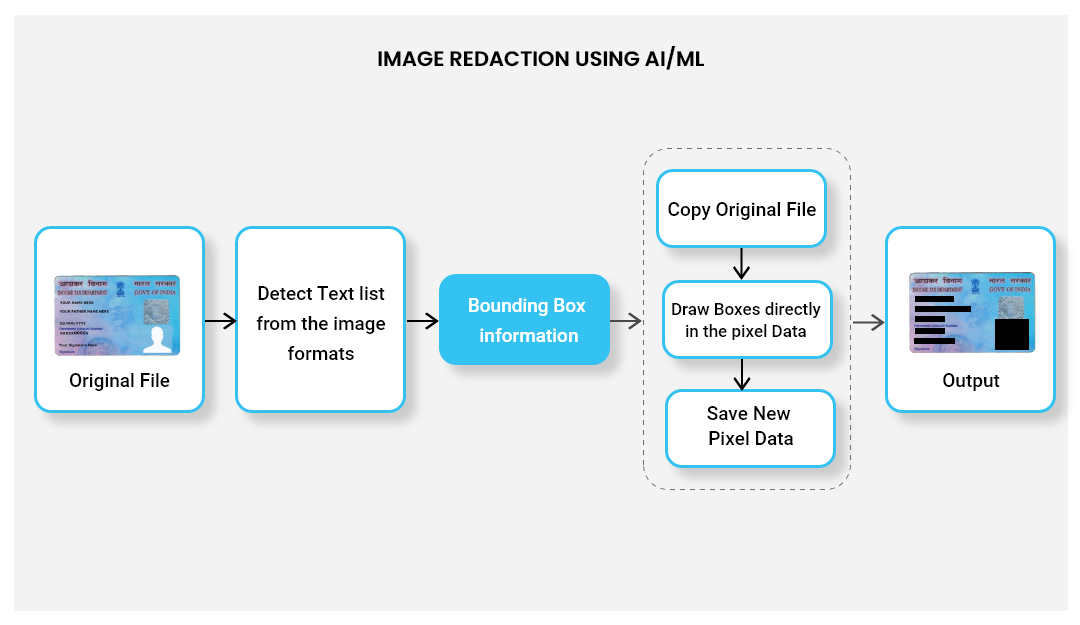

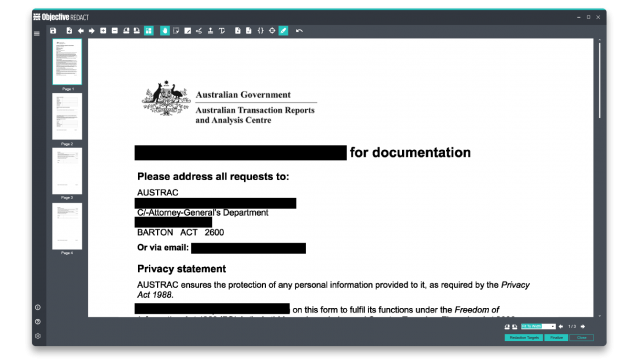

Our solution employed computer vision, machine learning, and rule-based intelligence to automatically identify and redact sensitive entities from documents. By removing manual interventions such as drawing boxes or altering text, we eliminated human error and prevented exposure of confidential data to search engines or unauthorized access.

This PII protection AI use case not only improved data security but also allowed the firm to maintain compliance while accelerating internal workflows.

Our privacy-preserving machine learning framework followed a robust, multi-stage process :

Data Collection :Identifying and consolidating all sources containing sensitive PII, including documents, emails, and databases.

Text Extraction : Converting unstructured data into machine-readable formats for efficient processing.

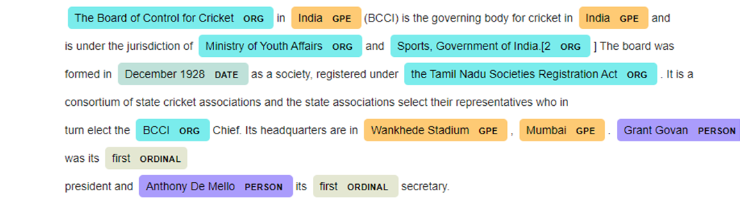

Processing :Using Named Entity Recognition (NER), custom regex, and rule-based algorithms to detect sensitive elements like names, SSNs, and credit card numbers.

AI Modeling : Applying fine-tuned BERT models for contextual redaction, ensuring accuracy in semantic understanding.

Output Generation : Producing fully redacted documents and datasets that maintain original formatting while ensuring privacy compliance.

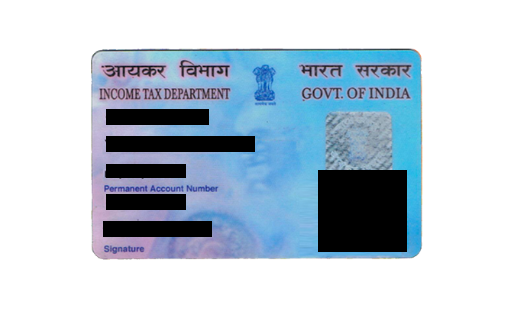

Our approach to AI for data security also extended to images detecting and masking sensitive text directly from pixel data to maintain complete visual privacy.

Automatically removing identifiable information from textual data.

Detecting and masking PII in visual content using advanced AI models.

Each of these processes embodies a scalable PII protection AI use case designed for industries where data integrity and compliance are non-negotiable.

Using NER algorithms to identify names, organizations, and locations for fraud detection and trend analysis.

The data anonymization AI solution enabled the client to securely process sensitive information without interrupting business operations. It significantly reduced the time spent on manual redaction, improved compliance readiness, and fostered trust among clients and regulators.

This implementation showcases how privacy-preserving machine learning and AI for data security can redefine data governance in financial services creating systems that are both intelligent and ethical.

Data redaction is just one example of how AI for data security can transform operations. As this PII protection AI use case proves, automation and intelligence can coexist with privacy.

Whether you’re exploring privacy-preserving machine learning to secure customer data or deploying data anonymization AI for compliance, our experts can help design solutions that align with your goals.

Let’s collaborate to unlock the next frontier of secure, scalable, and responsible AI innovation.